January–December 2020

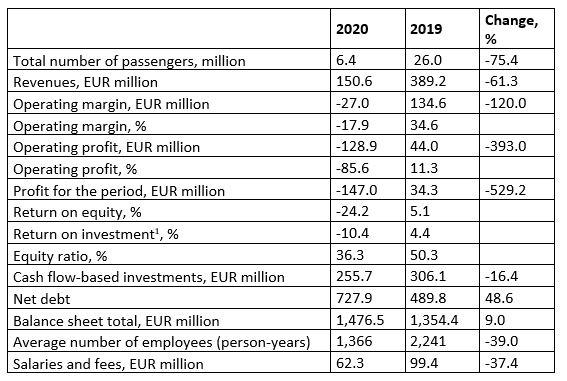

- The total number of passengers was 6.4 (26.0) million, showing a decline of 75.4% compared to January–December 2019.

- Revenues totalled EUR 150.6 (389.2) million, a decrease of 61.3%.

- The operating margin was EUR -27.0 (134.6) million, a decrease of 120.0%.

- The operating profit was EUR -128.9 (44.0) million, a decrease of 393.0%.

- Cash flow-based investments amounted to EUR 255.7 (306.1) million.

- Interest-bearing liabilities at the end of the review period amounted to EUR 802.0 (517.4) million.

- During the review period, Finavia took out EUR 235 million in new long-term loans, and EUR 70 million in short-term loans.

Unless otherwise stated, the figures in brackets are from the reference period, i.e. the same period in the previous year.

Finavia Group’s key figures

_______________________________

[1] The calculation of return on investment includes interest rate and other financing costs, whereas previously financial income and expenses were included.

Kimmo Mäki, CEO:

The year 2020 was extraordinary and the impacts on the entire aviation sector were completely unprecedented. Activity at Finavia’s airports slowed significantly. Our business environment changed dramatically. In 2019, a total of 26 million passengers passed through our airports. In 2020, that number was only about one quarter of the previous year’s total, or about 6 million passengers. Finavia’s profitability and result declined sharply due to the COVID-19 pandemic. Revenues declined by 61.3 per cent and amounted to EUR 150.6 million. The Group’s result was EUR -147 million.

Faced with difficult circumstances, Finavia Group started an extensive EUR 200 million cost-cutting programme. It included the prioritisation and reduction of investments as well as reductions in operating expenses. Implementing the cost-cutting programme has called for difficult decisions and engaging the commitment of the entire personnel. During the year, the focus was on ensuring Finavia’s financial operating conditions and health security as well as safeguarding its strengths and competitiveness. Finavia began preparations to strengthen the company’s equity and sought capitalisation of EUR 350 million from the state to ensure Finavia’s solvency and the completion of the Helsinki Airport development programme.

Finavia’s revenues and result

Finavia Group’s revenues for 2020 decreased by 61.3 per cent to EUR 150.6 million (389.2). The decline in revenues reflected the decrease in passenger volume. Revenues from air traffic decreased by 63.2 per cent to EUR 77.8 million (211.3).

Revenues from operations other than air traffic accounted for 48.3 per cent (45.7) of total revenues. The Group’s other revenues declined by 59.1 per cent. These include revenues from parking services, commercial revenues, rental income as well as the Airpro sub-group’s income from ground forwarding, security control, cabin services and customer services.

The Group’s operating result was EUR -128.9 (44.0) million, representing -85.6 (11.3) per cent of revenues. Due to the investment programme, depreciation increased to EUR 102.0 million (90.6).

The result for the financial year was EUR -147.0 (34.3) million. Financial expenses totalled EUR 14.2 (3.6) million. Interest expenses increased mainly due to the negative result of the associated company LAK Real Estate Oy as well as higher interest and financial expenses due to additional debt.

Outlook for 2021

The outlook for 2021 is highly uncertain. Forecasts indicate that air traffic will increase slightly compared to 2020.

The company expects its revenues for 2021 to be at the same level as in 2020. This expectation is based on the current view of the development of air traffic. The operating result excluding extraordinary items is estimated to be at the same level as in in 2020 while remaining negative by a very clear margin.

The Board’s proposal regarding the application of profits

The parent company’s distributable funds on the balance sheet date on 31 December 2020 stood at EUR 257,260,379, of which the loss for the period was EUR 151,043,937. The Board of Directors proposes to the Ordinary General Meeting of Shareholders that no dividend be distributed.

- Finavia Corporation’s Board of Directors’ report, financial statements and the Corporate Governance and Remuneration Statement are available on Finavia’s website.

- Finavia has also published an Annual Report and sustainability disclosures in accordance with the GRI Standards at Annual Reports -page.